Boss Energy: Reframing Value After the Honeymoon Review

Boss Energy (ASX: BOE)

Equity Research Update | Goldrock Capital

Recommendation: Buy

12-month Price Target (Base Case): A$1.75 per share

Current Share Price: A$1.56

Implied Upside: ~12%

Goldrock Capital position: Long

Average entry price: A$1.32 per share

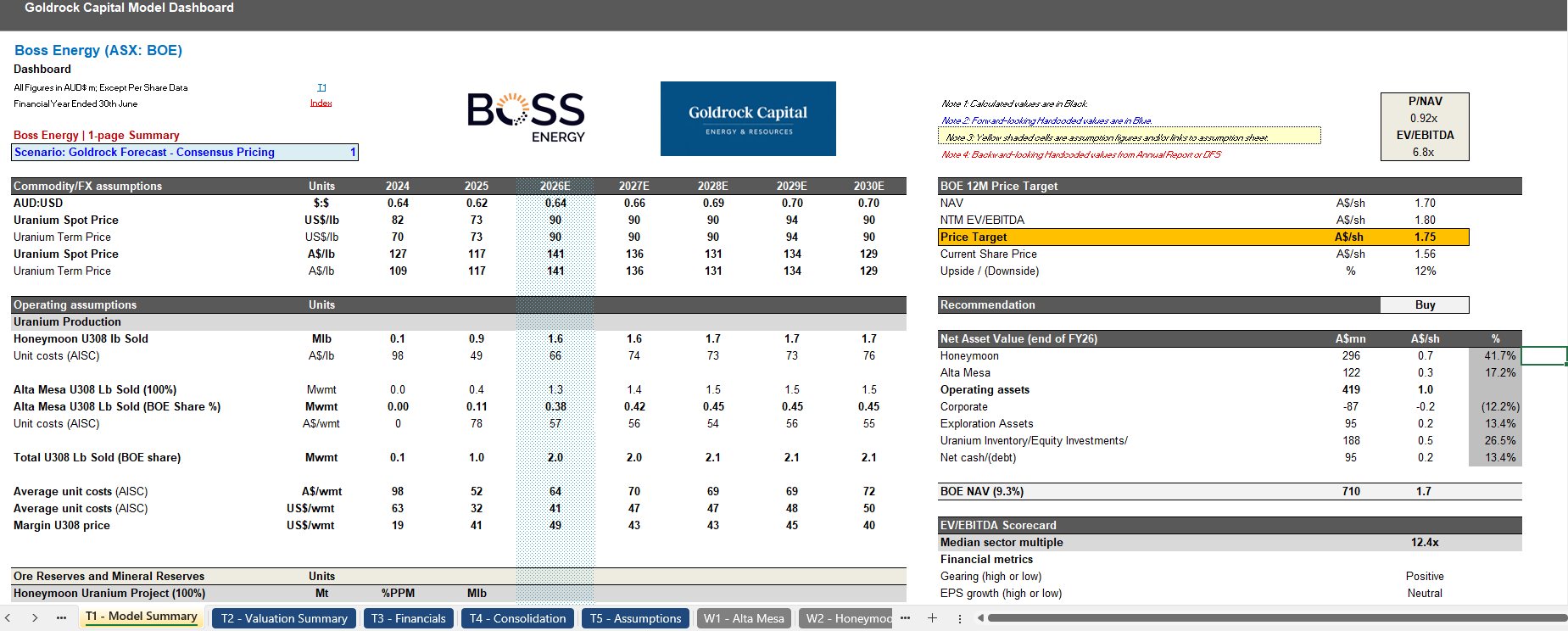

Model Extract 1: T1 Model Summary

Download the Goldrock Capital Model

We believe strong ideas should stand up to scrutiny

You can download our full Boss Energy valuation model for free by submitting your email address.

The model includes:

A full Honeymoon DCF with risk-weighted production, 3-statement financial model, Consensus commodity and FX assumptions, Comparables Analysis, and a transparent sum-of-the-parts valuation

Access is free. Just submit your name and email to download.

Why This Is Interesting Now

Boss Energy has undergone a meaningful reset following the Honeymoon operational review. Guidance has been pulled back, the Expanded Feasibility Study withdrawn, and market expectations have repriced sharply.

Goldrock Capital has taken a position through this reset at an average cost of $1.32 per share. While uncertainty around Honeymoon has increased, we believe the market reaction has gone too far. The stock now reflects a high degree of pessimism, despite a balance sheet and asset base that materially limit downside and preserve upside optionality.

Our A$1.75 base-case price target is intentionally conservative. It is built using consensus uranium pricing, explicit risk-weighting beyond guidance, and a clear separation between bankable value and optionality. It does not rely on a return to nameplate capacity, aggressive commodity assumptions, or long-dated mine life extensions.

The withdrawal of the Expanded Feasibility Study and the decision to guide production only through FY27 marked a clear change in management posture. The share price fell sharply, short interest remains, and longer-dated assumptions were rapidly unwound.

In our view, this has shifted Boss Energy from a growth-assumed producer to a valuation-anchored opportunity. The stock is now priced for disappointment, which matters because outcomes that are merely less bad than feared can drive meaningful upside from here.

How We Value Boss Energy

Our A$1.75 price target reflects a blended valuation approach:

NAV-based valuation: ~A$1.70 per share

NTM EV/EBITDA valuation: ~A$1.80 per share

(8.0x multiple versus a sector median of ~12.4x)

We apply a discount to sector multiples to reflect:

Limited mine life visibility at Honeymoon,

Cost pressure following the operational review, and

Capital allocation uncertainty in the near term.

The result is a base-case valuation that we believe is achievable without optimistic assumptions.

Commodity and FX Assumptions

To avoid embedding macro optimism, we anchor the model to consensus assumptions:

AUD/USD: ~0.64–0.70

Uranium pricing:

US$90/lb through FY26–FY28

US$94/lb in FY29

US$90/lb thereafter

At these levels, uranium pricing equates to ~A$130–140/lb, supporting solid margins even under conservative cost assumptions.

Operating Assumptions and Asset Framework

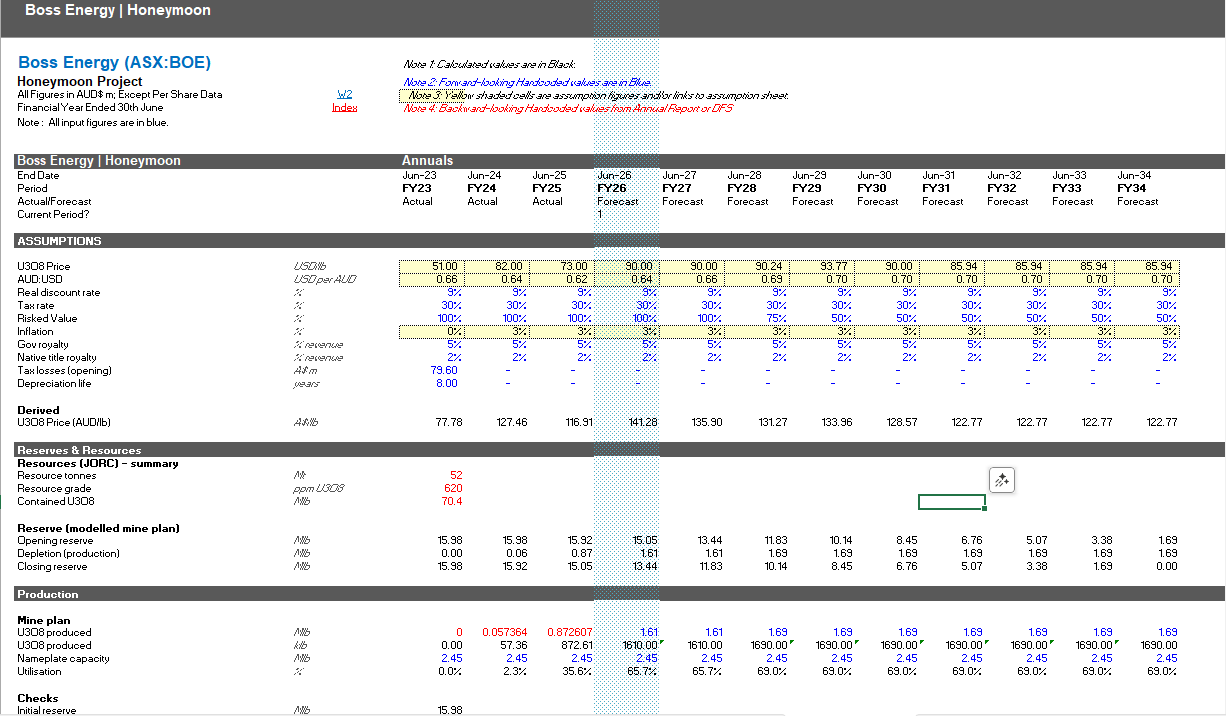

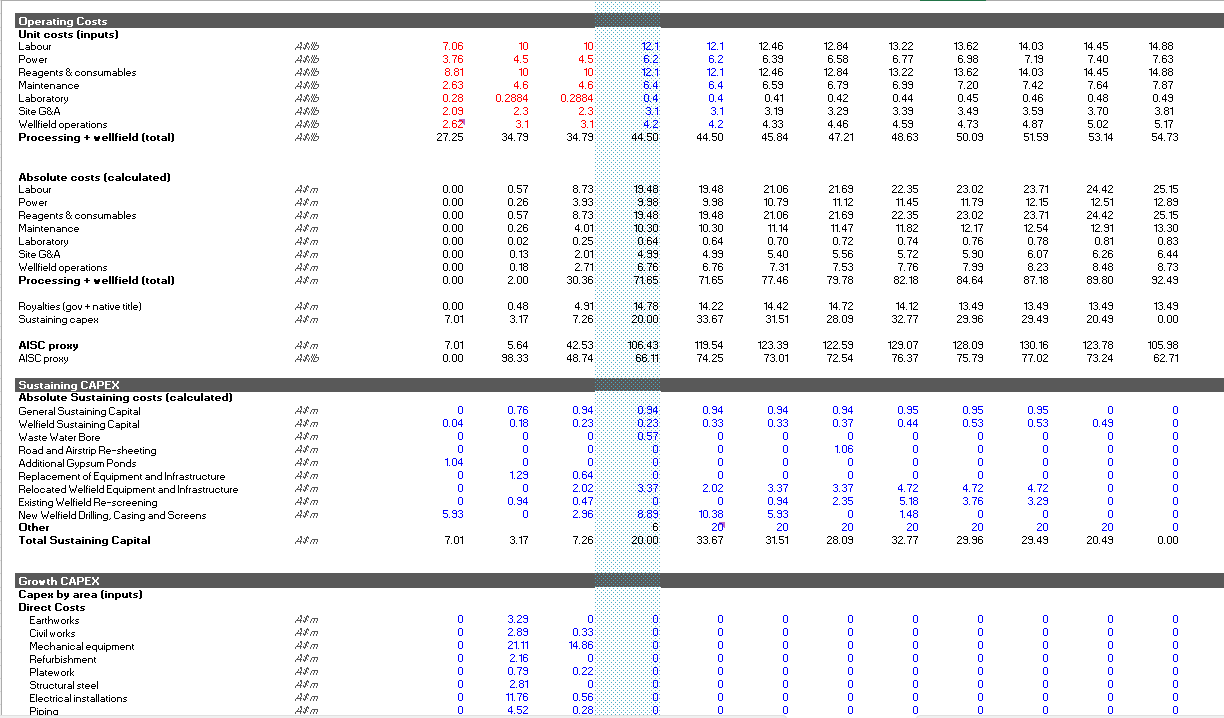

Honeymoon: Conservative and Explicitly Risk-Weighted

For Honeymoon, we anchor assumptions to guidance and avoid embedding unproven mine life extensions:

Production ramps to ~1.6 Mlb per annum, with no return to nameplate

AISC averages ~A$70–75/lb from FY26 onward

No expansion capital or revised mine plan assumed

Production beyond guidance is explicitly risk-weighted:

FY26–FY27: 100%

FY28: 75%

FY29 onward: 50%

This reflects geological uncertainty identified in the review while acknowledging the existence of resources and satellite deposits. Near-term cash flow is valued; long-dated certainty is not assumed.

Model Extract 2: Honeymoon U308 Valuation

Model Extract 3: Honeymoon U308 Valuation

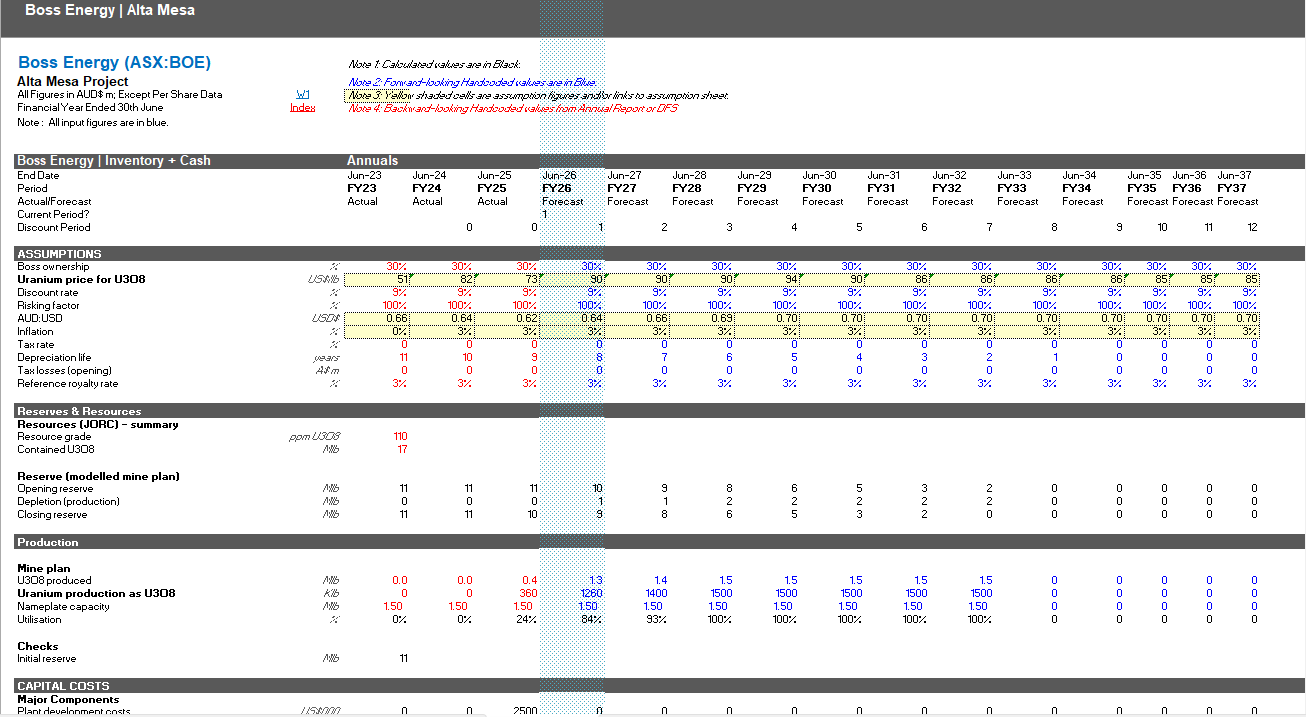

Alta Mesa: Diversification Matters

Alta Mesa provides important diversification. Operated under a different geology, jurisdiction, and operator, it reduces reliance on a single asset outcome.

In our model, Alta Mesa ramps toward ~1.5 Mlb per annum (100% basis), with Boss’s 30% share contributing meaningfully from FY26. Unit costs trend to the mid-A$50s per pound, supporting robust margins at consensus pricing.

Model Extract 4: Alta Mesa U308 Valuation

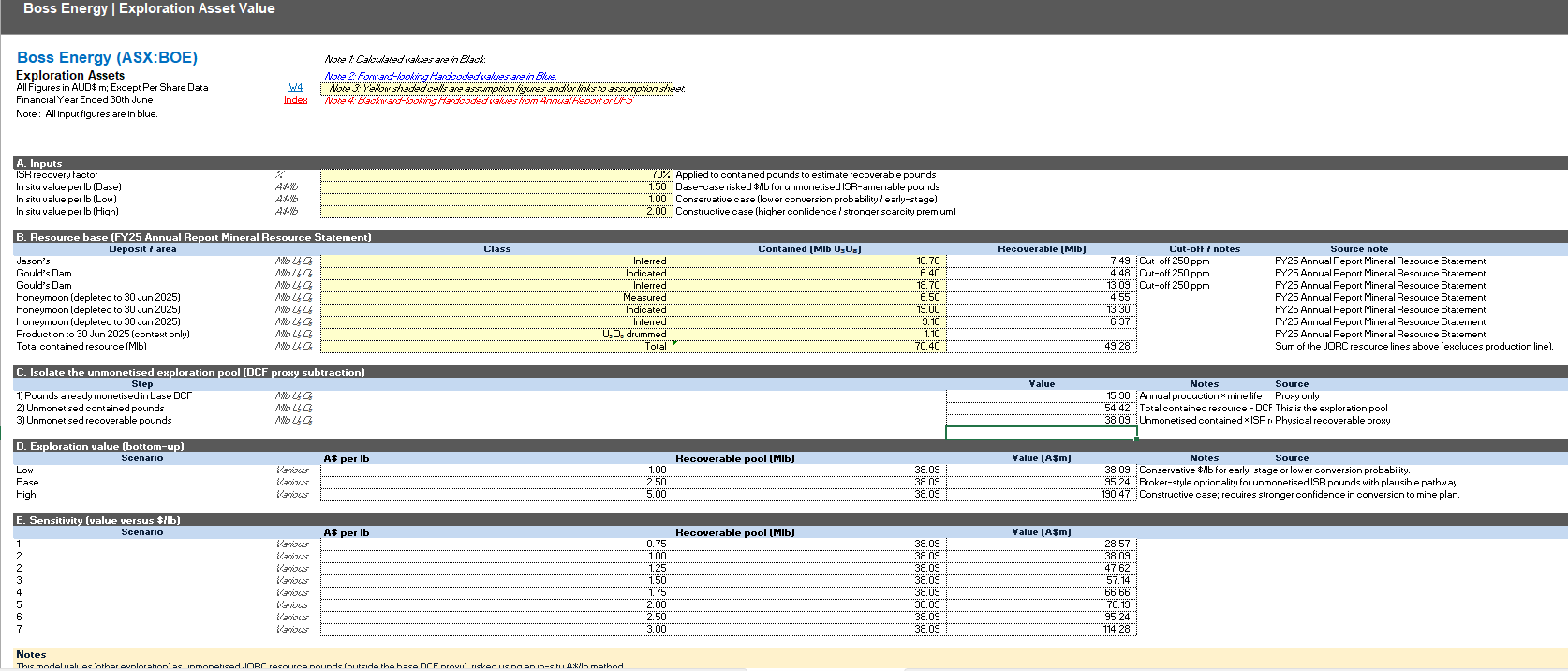

Exploration Assets: Optionality, Not Assumed Value

Exploration assets are treated as option value, not assumed mine life.

Boss controls approximately 70.4 Mlb of contained U₃O₈, equating to ~49.3 Mlb recoverable after ISR recovery. Only ~16.0 Mlb is monetised in our Honeymoon DCF.

The remaining ~38.1 Mlb represents an unmonetised exploration pool. These pounds are JORC-defined and represent the pathway to extending Honeymoon’s life, but are not yet supported by post-review economics.

We value this optionality at A$2.50 per recoverable pound, implying ~A$95 million, without assuming reserve conversion, timing certainty, or development approval.

Model Extract 5: Alta Mesa U308 Valuation

Inventory and Cash: Tangible Value and Time

At FY26, Boss is expected to hold ~A$236 million of cash and liquid assets (~A$0.57 per share), including:

~A$100 million of cash and liquid investments, and

~1.44 Mlb of drummed U₃O₈, worth ~A$130 million at consensus pricing.

This inventory is already produced and saleable, carries no operating risk, and provides direct uranium exposure. We view it as a strategic asset, not working capital.

The balance sheet gives management time. It allows technical work and mine planning to progress without pressure to raise equity or rush decisions. In the current environment, that flexibility has real value.

Financial Profile

Under our base case:

Underlying EBITDA rises to ~A$150m in FY26

Free cash flow turns sustainably positive from FY26

Net cash builds steadily, exceeding A$300m by FY30

No dividends assumed; capital is retained to preserve flexibility

What Drives Upside (and Risk)

Upside drivers

Outcomes at Honeymoon that are less bad than feared

Short covering given elevated short interest

Continued strength in uranium pricing

Key risks

No viable pathway beyond FY27 at Honeymoon

Persistently higher costs

Exploration failing to convert into bankable mine life

These risks are explicitly reflected in our assumptions.

Conclusion

Boss Energy is no longer a simple growth story. It is now a valuation-driven opportunity with asymmetric upside

At current levels, the stock is priced for disappointment. Our A$1.75 base-case price target does not require optimism, only outcomes that exceed the market’s now-lower expectations

If you want to understand exactly how this valuation is built and test the assumptions yourself, we encourage you to download the Goldrock Capital model

Disclaimer

Goldrock Capital and its partners hold shares in Boss Energy (ASX: BOE). This article is not financial advice and is published for discussion and educational purposes only. Readers should conduct their own research and seek independent advice before making investment decisions.