Woodlawn: a simple way to own zinc, with copper as a bonus

Why zinc

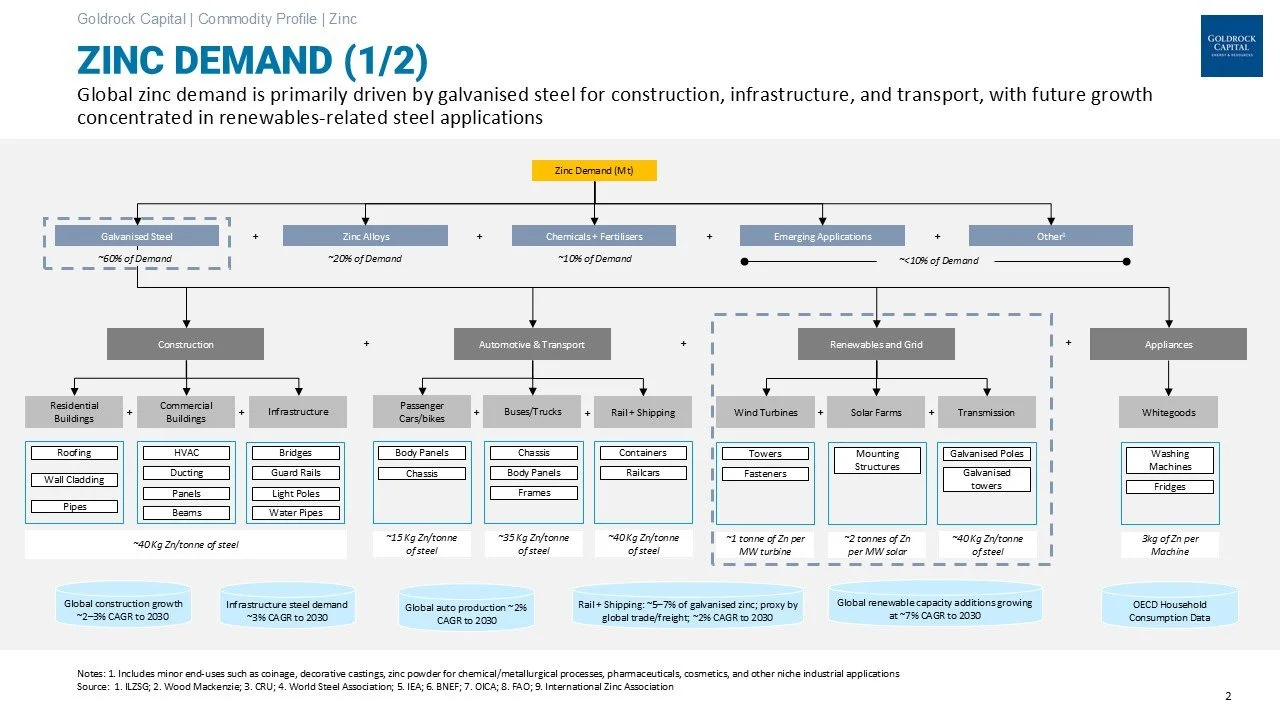

Zinc is essential, even if it is rarely in focus. About 60 percent of global zinc is used to galvanise steel, the coating that stops it from rusting. You find it in solar frames, wind towers, substations, power lines and structural steel.

At the time of writing, global zinc inventories on the London Metal Exchange sit below 30,000 tonnes. That is less than a day of global consumption. It suggests that any supply disruption or demand surprise could squeeze prices.

HSBC and others expect a small surplus in 2025, with global zinc supply of around ~14 million tonnes against demand of about ~13.9 million tonnes. That reflects soft construction activity and delayed renewable investment. The demand side has underwhelmed. But the supply response has been fragile, and the concentrate market has only just started to loosen. Treatment charges dropped to 50-year lows this year, which suggests miners still have leverage.

What matters to us is the longer-term pull from renewables. Onshore wind uses around 1,000 tonnes of zinc per gigawatt of capacity. Solar is even higher, at around 2,000 tonnes per gigawatt, because of all the steel in mounting frames. If the world builds 500 gigawatts of solar a year, that is roughly 1 million tonnes of zinc just for that segment.

That demand is not all priced in. If the pause in wind and solar turns, zinc demand could rise faster than expected. Even modest acceleration could shift the market back into deficit. We are not betting on a squeeze, but we like owning zinc at this point in the cycle

Image 1: Zinc Demand Drivers (1/2)

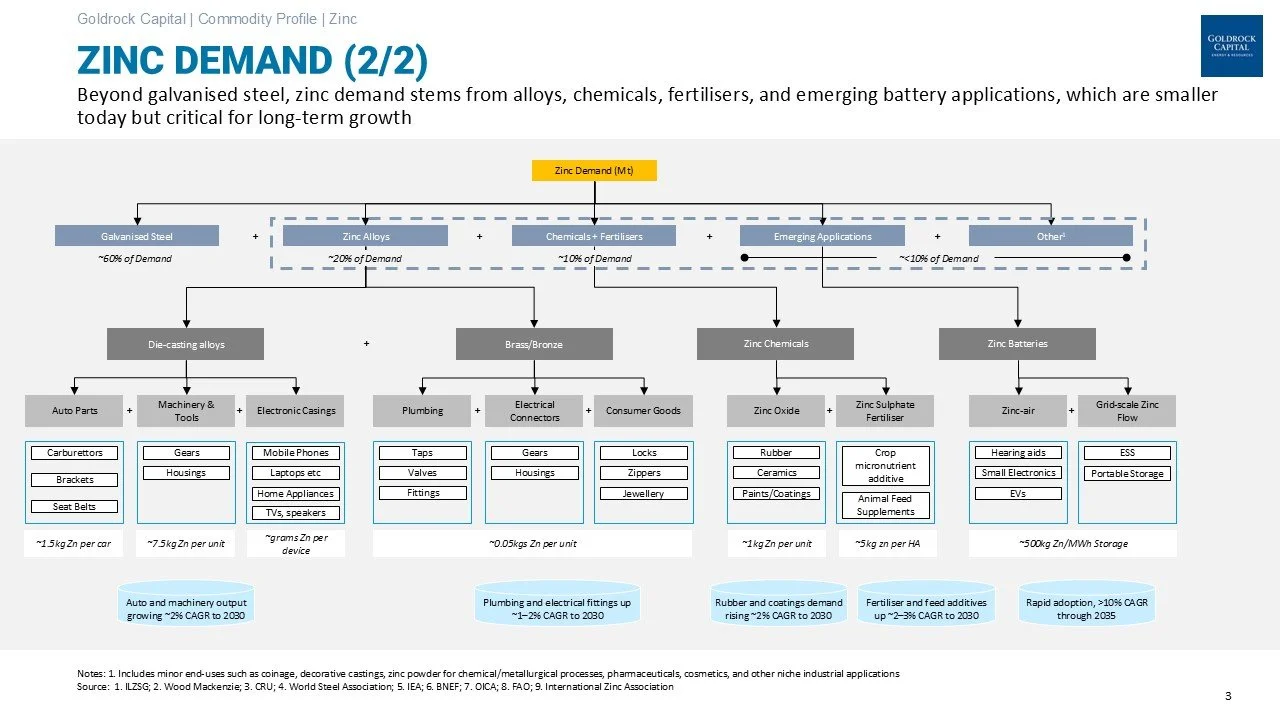

Image 2: Zinc Demand Drivers (2/2)

Image 3: HSBC Zinc/Supply and Demand Forecast

Why Develop Global

We wanted local exposure to zinc and copper in a company we can understand. Develop Global fits that brief. It owns 100 percent of the Woodlawn Mine in New South Wales and is led by Bill Beament (MD) and Michael Blakiston (Chair). Both have long track records in Australian mining and are well regarded for their operational and commercial experience.

Woodlawn is an underground polymetallic mine that produces zinc and copper concentrates, with lead, silver and gold as by-products. It is not a new story, but it is a tangible one. The orebody is well drilled, the plant is built, and the restart plan is detailed (with production already underway).

What we modelled

We built a simple model to test what Woodlawn is worth under conservative price settings. The model tracks ore mined, ore milled, recoveries, payabilities, realised prices, treatment and refining charges, transport, royalties and site costs. A summary is attached in the model extract.

We used zinc prices consistent with HSBC’s base case, which assume a gradual recovery from about US$2,700 a tonne in 2025 to around US$2,900 a tonne by 2028. For copper we used roughly US$10,000 a tonne. These are realistic, not heroic, assumptions.

Even with those inputs, Woodlawn screens well. The mine has leverage to both zinc and copper, and it generates solid cash margins once steady-state production is reached.

Image 4: Revenue Model Extract (1/3)

Image 5: Revenue Model Extract (2/3)

Image 6: Revenue Model Extract (3/3)

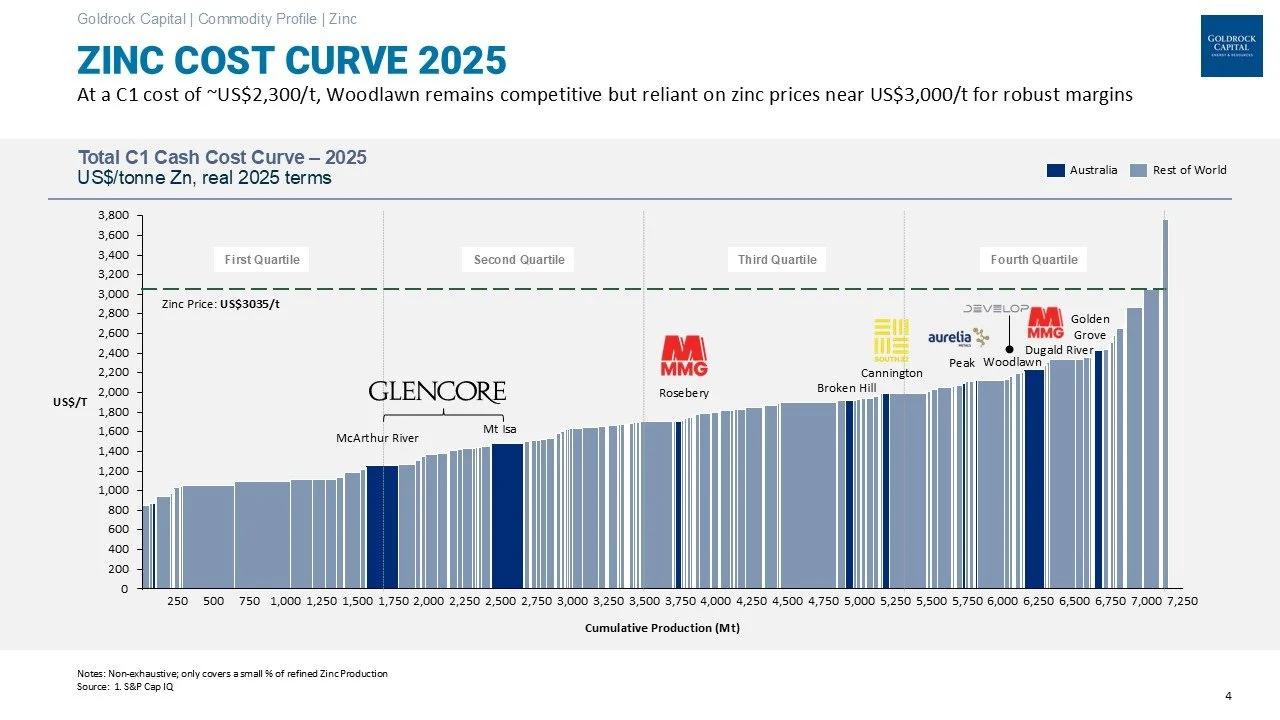

Costs and competitiveness

Woodlawn sits on the upper half of the cost curve, but that does not bother us. It is an underground mine with real development costs, but it also benefits from by-product credits and a weaker Australian dollar. When zinc prices rise, the cash flow response is strong.

Because Woodlawn has scale and modern infrastructure, it is still protected from the truly marginal producers. Smaller, higher-cost operations in Latin America and Africa are more likely to shut first in a downturn, which helps support prices and protect cash flow for mines like Woodlawn.

Image 7: Cost Model Extract

Image 8: Zinc Cost Curve 2025 (Non-exhaustive)

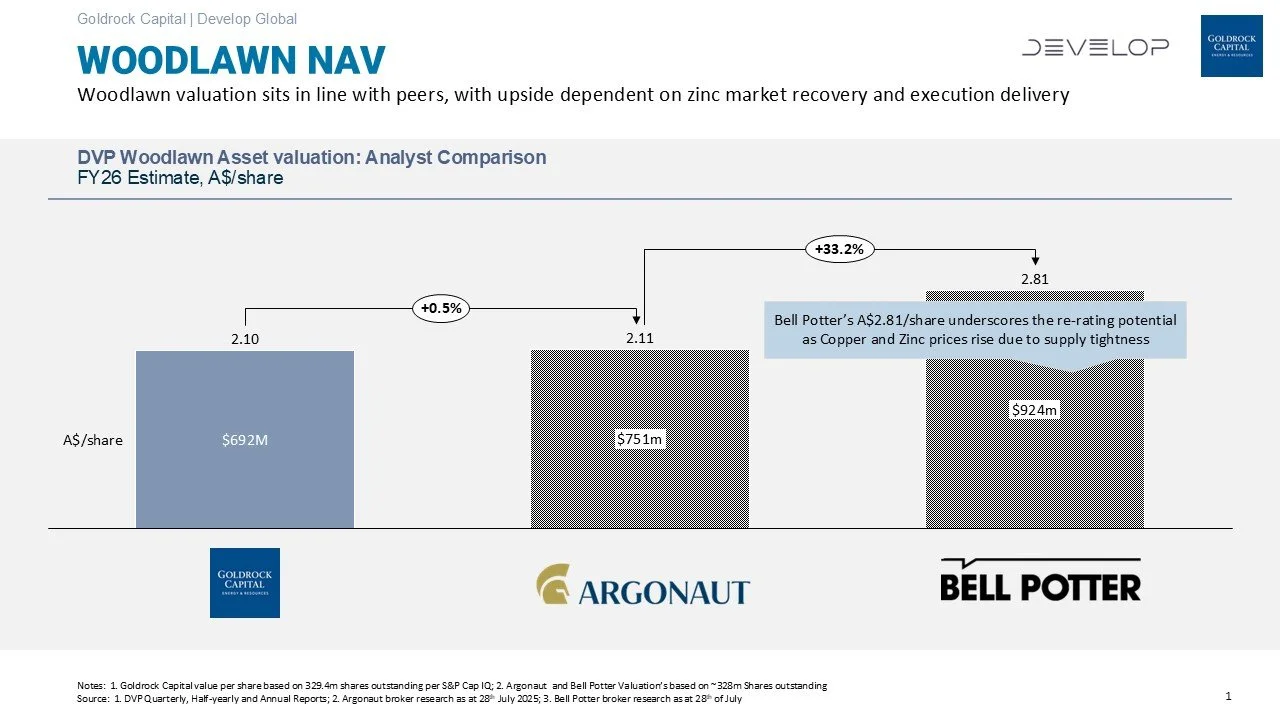

What it is worth

Our FY26 net asset value for Woodlawn is $2.10 per share, broadly in line with Argonaut’s $2.11 and below Bell Potter’s $2.81. The difference mainly reflects our more cautious price deck and higher sustaining capital. See the Woodlawn NAV Comparison slide for detail.

If zinc prices follow HSBC’s forecast, we think our valuation is fair. If zinc recovers faster because of a rebound in renewable investment or grid expansion, the upside could be meaningful. A 10 percent lift in zinc price adds meaningfully to our NAV.

Image 9: Woodlawn NAV Comparison

Risks to watch

Every investment carries risk. For Woodlawn, the key ones are:

Zinc prices could stay flat longer than expected if renewable projects remain delayed.

Ramp-up underground is technically complex and can take longer than planned.

Concentrate penalties or moisture could reduce realised prices.

Sustaining capital and working capital could run higher than forecast.

Leverage during the ramp phase needs to be managed carefully.

We think the management team understands these risks and has the capability to handle them.

Why we own it

We wanted exposure to a metal that is essential to the energy transition but currently overlooked. Zinc fits that theme. Develop gives us a way to own it locally, with a proven team, a clear restart plan and good leverage to any recovery in prices.

We have added Develop Global to the portfolio. This note focuses on Woodlawn only. We will share a full company-level valuation in a later piece.

Disclaimer

Goldrock Capital and its partners hold shares in Develop Global (ASX: DVP). This article is not financial advice and is published for discussion and educational purposes only. Readers should conduct their own research and seek independent advice before making investment decisions.