Should Wodgina Shut?

Wodgina Shutdown Price: Still Worth Running (Just)

As lithium markets continue to test producer margins, investors are revisiting the economics of key Australian operations. For Mineral Resources (MinRes), the spotlight is firmly on Wodgina, its flagship hard rock lithium joint venture with Albemarle.

With SC6 spot prices sitting at ~$626 USD/t, the core question is whether it still makes sense to run Wodgina, or whether MinRes should place it into care and maintenance until the market rebounds.

Our view at Goldrock Capital: Wodgina remains marginally cash flow positive (on FOB-basis), and the optionality of staying open adds real value. But the margin is tight, and a sustained price drop below $442 USD/t would likely flip the logic.

Price at Which MinRes Will Close Wodgina

0. Context behind JV

As lithium markets continue to test producer margins, investors are revisiting the economics of key Australian operations. For Mineral Resources (MinRes), the spotlight is firmly on Wodgina, its flagship hard rock lithium asset, owned 50:50 in joint venture with Albemarle.

Wodgina is currently producing ~256ktpa of SC6 concentrate, with each party entitled to 50% of offtake and obligated to fund its share of operating costs. However, the incentives for each partner aren’t aligned.

MinRes benefits from internal mining services revenue, which offsets some of its production costs.

Albemarle does not, meaning its effective breakeven is materially higher.

And due to the 50:50 structure, unanimous JV consent is required to shut the mine, adding complexity to any decision.

This structural tension matters. MinRes may prefer to keep Wodgina running at lower prices than Albemarle, especially when you factor in optionality value and internal margin capture. That means the shut decision isn't just about cash cost, it’s also about governance.

1. What Does MinRes Actually Earn at Today’s Prices?

Wodgina sells SC5.5 spodumene concentrate. The current realised price is $626 USD/t, which aligns to 100% of published index pricing. Wodgina typically realises ~92% of the SC6 pricing Index, resulting in an estimated pricing of $575 USD/t. From that:

A 5% royalty is deducted

MinRes owns 50% of the JV

MinRes net revenue = $575 × (100% – 5%) × 50% = $273/t

2. What Are the Costs, and What’s Actually Avoidable?

Wodgina’s latest reported FOB cost is $775 AUD/t, which converts to $511.50 USD/t at a 0.66 exchange rate. This includes core opex: crushing, hauling, administration, power, etc.

On top of this is $293.50 USD/t in sustaining capex, representing major replacements and long-term mine site upkeep (source: BMI Q1 2025 Forecast)

Critically, not all sustaining capex disappears if the mine is shut. We reviewed past site disclosures and industry benchmarks (including Pilbara Minerals and IGO's guidance) and conservatively assume that only 35% of sustaining capex is avoidable during shutdown (meaning that regardless of whether wodgina is operating or shut, they’d still have to pay 65% of remaining sustaining capex to align with pre-committed requirements)

Avoidable capex = $293.50 × 35% = $102.73/t

Total avoidable cost = $511.50 + $102.73 = $614.23/t

MinRes share (50%) = $307.11/t

3. Services Margin Offsets Cost Pressure

One of the often-overlooked parts of the Wodgina cost structure is that MinRes earns internal margin through Mining Services, even if the JV asset itself is breakeven or loss-making.

Based on disclosures, MinRes receives $5.88 AUD per tonne moved, and with a strip ratio of 8.1 t moved per tonne concentrate, that’s:

$5.88 × 8.1 ÷ 0.66 FX = $31.43 USD/t

This is paid regardless of lithium pricing, and 100% flows to MinRes, even if the JV is in loss territory. At today’s pricing, this is the difference between modest profit and a shut decision.

4. Option Value: Staying Open Lets You Capture the Upside

Shutting Wodgina saves cash, but it also delays your ability to monetise price upside.

We model a 12-month scenario with:

70% chance of price rising to $900 USD/t

30% chance of price staying at $700 USD/t

Ramp-up delay of 6 months if shut

This yields a weighted average price of $840 USD/t, and missing 6 months of production (as part of ramp-up time) at this level costs MinRes around $2m USD — or $15.72/t in lost optionality value.

This optionality matters — and it’s real money if you shut too soon

5. What Price Justifies a Shutdown?

We modelled several breakeven price scenarios using different assumptions for sustaining capex and whether price upside is captured. The leading scenario based on assumptions derived from publicly available information and analysis pointed to a breakeven SC6 Price (USD/t) of $442.

Normally, sustaining capex is not relevant to the shut down decision as it’s assumed the capital is incurred regardless of operation or not. However, in this case we’ve assumed that 35% of sustaining capex is still incurred if we continue to run. This scenario also includes option value + Mining Services value vs. Breakeven point equivalent to the care & maintenance figure)

At today’s SC6 Index price of $626 ($575 for MIN’s), Wodgina remains marginally above water, but if prices fall another $130/t, shutdown becomes more defensible.

Minres Margin per tonne of SC6 at Current Prices

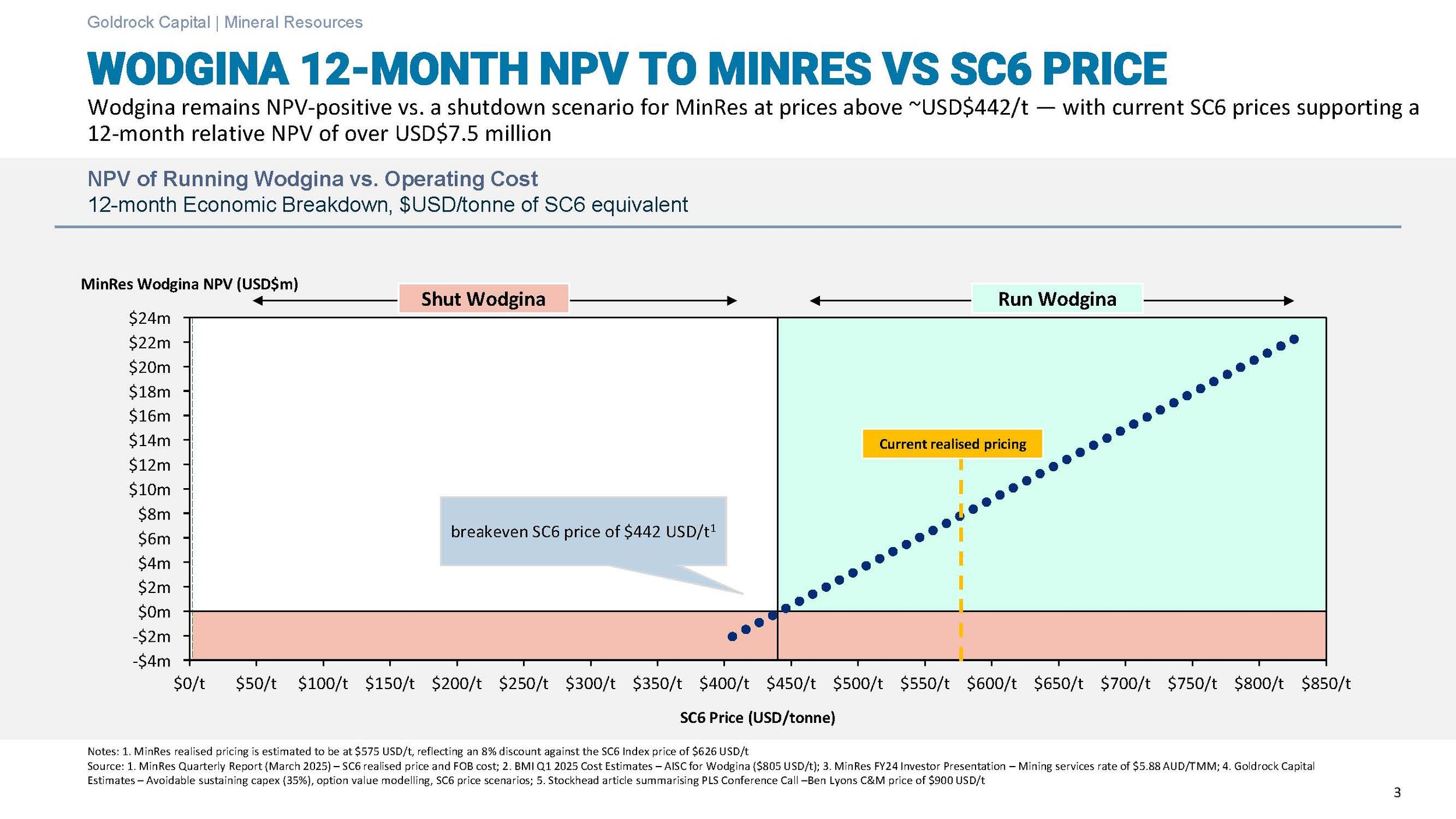

6. NPV: What’s the Difference Over 12 Months?

Using a 9.5% discount rate and monthly cash flow estimates, we find:

MinRes 12-month NPV of running Wodgina = $7.5m USD

If shut, this NPV falls to near zero due to C&M cost and lost upside

This provides a real buffer, but it’s modest. If spot prices fall another ~20%, NPV quickly drops below zero.

Wodgina 12-month NPV to Minres vs SC6 Price

7. Why This Is Different to PLS’s $900/t Threshold

Some investors and analysts have pointed to Pilbara Minerals’ decision to mothball its Ngungaju plant, citing a care and maintenance cost of around US$900 per tonne, as an indicator of where spodumene prices must sit to justify closure. But drawing a direct comparison between Ngungaju and Wodgina risks missing the nuance.

Ngungaju was a relatively small-scale operation, producing only around 100 to 120 thousand tonnes of spodumene concentrate annually. That smaller output base meant its fixed costs were spread across fewer tonnes, driving up the per-tonne cost of care and maintenance. Moreover, the plant relied on legacy infrastructure inherited from Altura, which was less efficient and more costly to maintain than modern assets.

Wodgina, in contrast, is a Tier 1, world-scale operation. It produces roughly 250 thousand tonnes of SC6 per year using modern processing facilities developed by Mineral Resources and Albemarle. The scale of Wodgina allows care and maintenance costs to be amortised across a much larger volume, driving per-tonne costs materially lower. We estimate Wodgina’s care and maintenance cost at approximately US$100 per tonne, less than one-ninth of Ngungaju’s figure.

Final Take

Wodgina is tight but rational to keep running at current spot prices. It is cash flow positive by:

Earning ~$63/t in economic margin ($13 net margin + $50 C&M avoidance cost)

Benefiting from ~$31/t of services uplift

Holding ~$16/t of option value in a volatile market

That said, sustained spot prices below $442 USD/t would likely justify a shutdown, particularly if price rebound scenarios fall away.

In the meantime, MinRes has done well to hold production discipline while retaining optionality. Wodgina’s breakeven floor remains far below market headlines, and that’s a strategic edge investors shouldn’t overlook.

All assumptions and breakeven workings are available in the simple Goldrock Capital model extract below.

You can download the PDF files here:

This analysis has been prepared by Goldrock Capital for informational purposes only and does not constitute financial advice, investment advice, or a recommendation to buy or sell any security. The figures presented are based on public information, industry benchmarks, and assumptions that may not reflect the actual internal costs or commercial decisions of Mineral Resources or its joint venture partners.

Where data has not been disclosed, reasonable estimates have been applied based on comparable operations and historical disclosures. If more granular or forward-looking guidance were available from Mineral Resources, the cut-off economics and breakeven price thresholds could be more precisely determined.

Readers should treat this analysis as indicative and not definitive. Goldrock Capital and its contributors accept no liability for any decisions made based on this content. Always conduct your own research or consult a licensed financial adviser before making investment decisions.