When the Market Caught Up to the Model: Our Santos Call Explained

Santos Has Returned to Fair Value - Just as We Expected

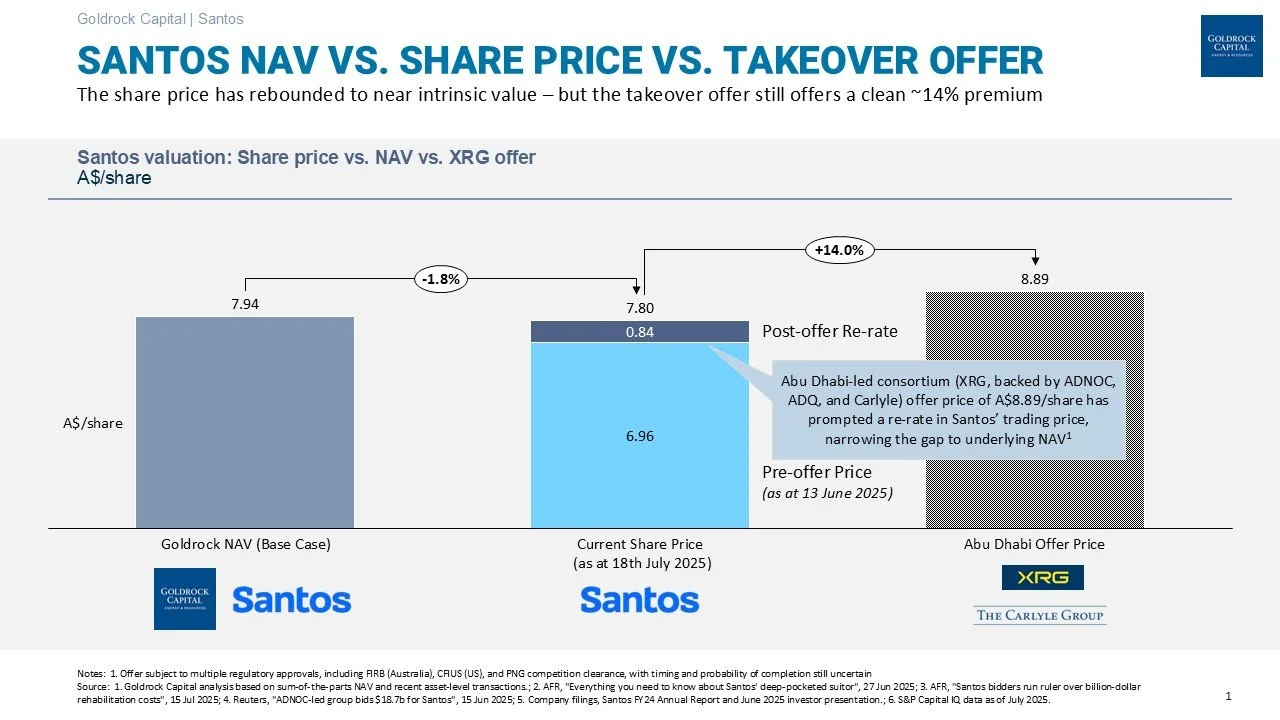

We initiated our position at A$5.50 on 11 April 2025, when Santos was trading well below intrinsic value. LNG spot prices were soft, capex was climbing, and there wasn’t much of a narrative.

This Was Never About the Bid

Let’s be clear - the current share price is being propped up by the A$8.89 takeover offer from the Abu Dhabi–led XRG consortium. But the offer isn’t some speculative stretch. The current re-rate closely reflects our fair value NAV of A$7.94, and confirms what we already believed: Santos was mispriced. Now it’s not.

If the deal collapses, the price will likely retreat. But that doesn’t take away from the fact that the underlying valuation was there all along - and Goldrock was positioned ahead of the market.

Santos NAV vs. Share Price vs. Takeover Offer

The Real Thesis: Strong Base Business, Undervalued Assets

Our NAV was built using conservative, mid-cycle assumptions - no heroics. Even now, at these levels, the underlying business is sound. But if the bid falls over, value may fall with it.

We accept that risk. That’s why we’ve taken profits.

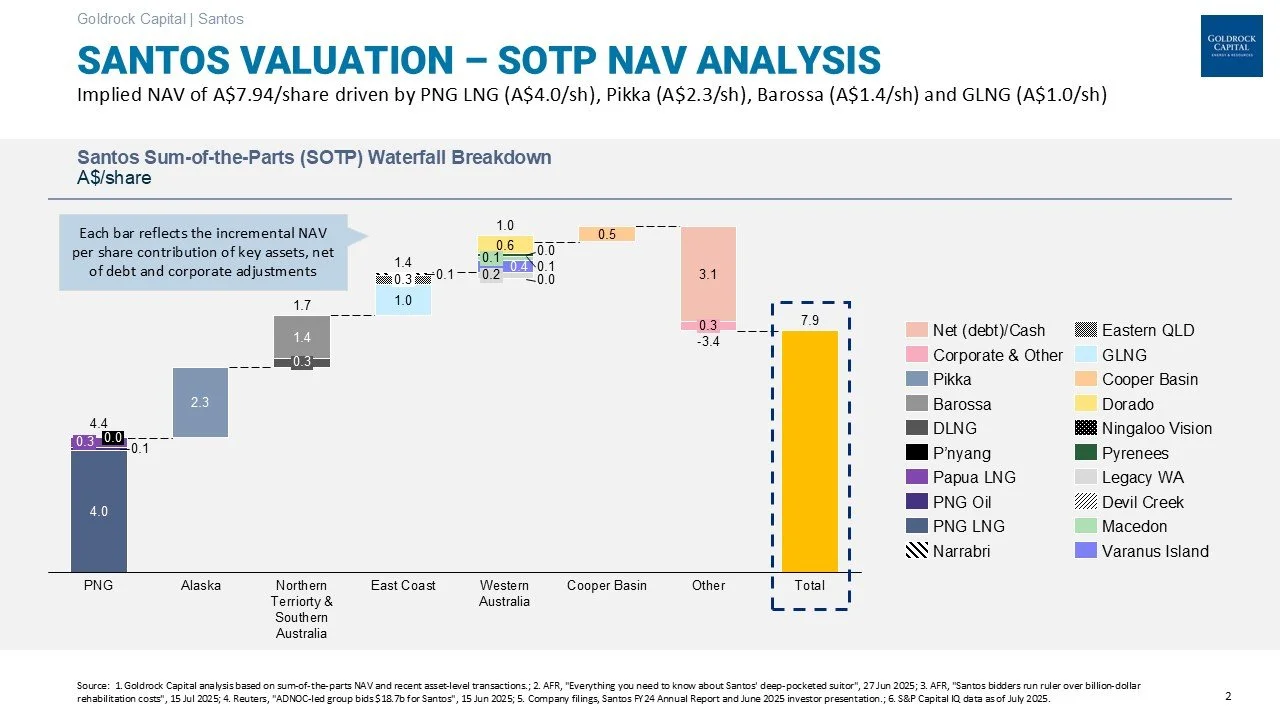

How We Built the NAV

Our NAV is grounded in a detailed asset-by-asset valuation, underpinned by 2025–2030 forecasts for production, pricing, EBITDAX, capex, and net debt.

We assume:

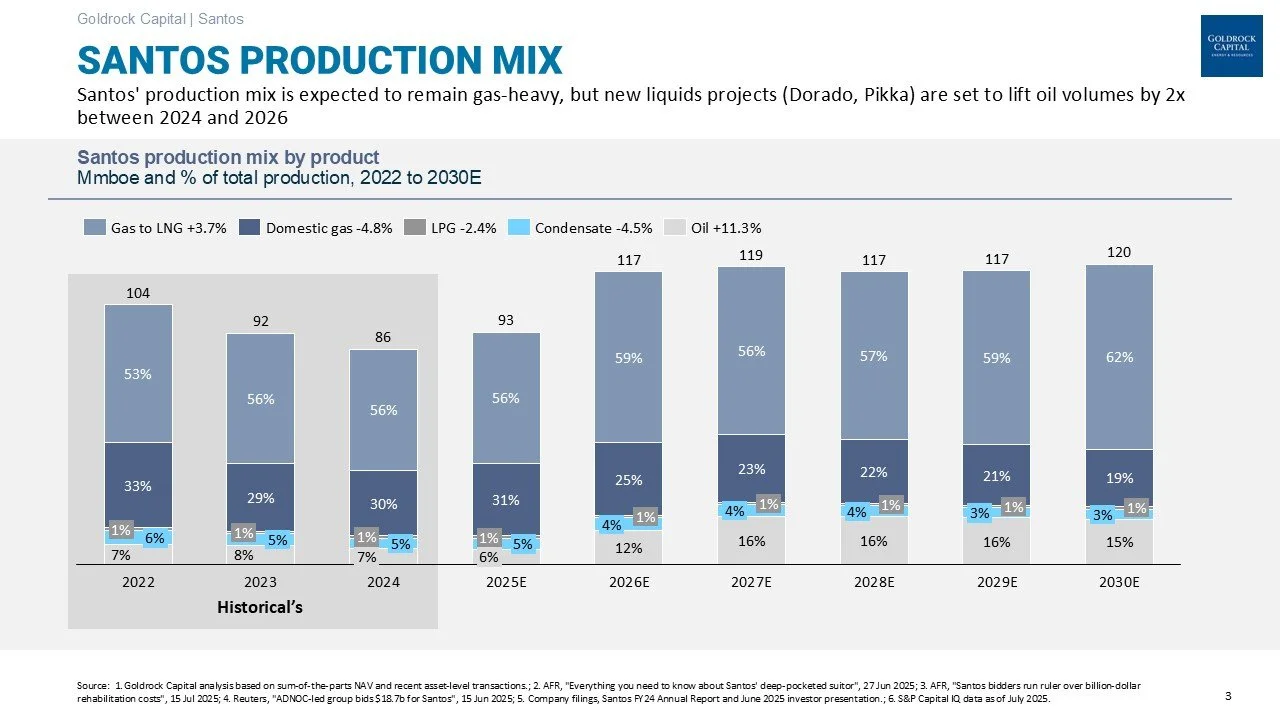

• Production grows from 93 mmboe in 2025 to 120 mmboe by 2030

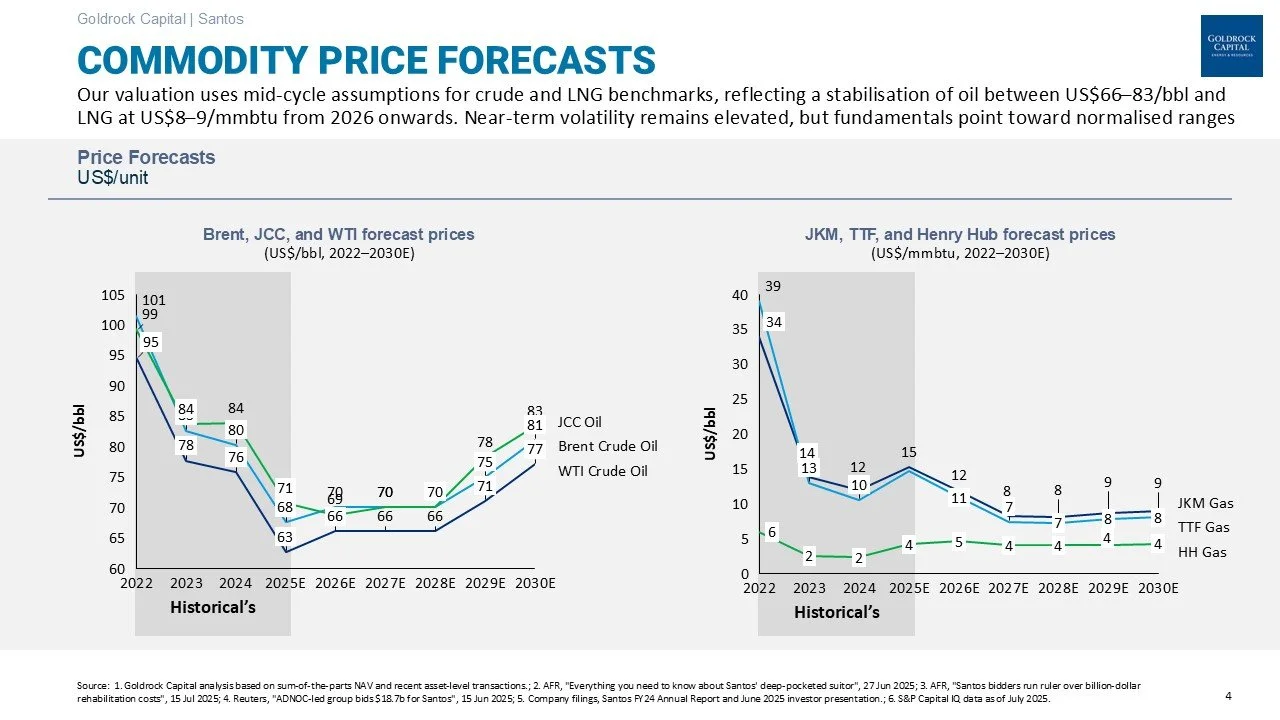

• Brent crude ranges between US$68–75/bbl, JCC oil broadly tracks Brent with a ~US$2–3/bbl discount

• JKM LNG moderates from US$15.2 in 2025 to US$8.6–8.9/mmbtu by 2029

• A large portion of LNG exposure remains oil-linked, shielding margins from JKM volatility

This gives us a base case NAV of A$7.94/share, driven by stronger Dorado confidence, cost discipline in Cooper, and an improved AUD/USD profile.

What the NAV Shows

Santos Valuation - SOTP NAV Analysis

Production Mix: Gas-Led, Liquids Rising

The base business is still gas-heavy, but liquids growth is no longer hypothetical. Oil volumes are expected to triple from 6 mmboe in 2025 to 18 mmboe by 2030, supported by Dorado and Pikka.

It’s a simple story: LNG keeps the lights on. Liquids bring the upside.

Santos Production Mix

The Price Assumption(s) That Anchor It All

We assume:

• 2025 – Brent US$68, JKM US$15.2

• 2026 – Brent US$70, JKM US$11.8

• 2027 – Brent US$70, JKM US$8.2

• 2028+ – Brent US$70–77, JKM US$8.0–8.9

With this in mind, we weren’t betting on price. We were betting on underappreciated infrastructure, a disciplined portfolio, and predictable cash flows.

Commodity Price Forecasts

So What Happens Next?

We’ve taken some profits now that Santos has re-rated to our NAV. Whether the bid proceeds remains uncertain. FIRB approval is far from guaranteed and PNG political dynamics remain fluid.

We’re actively analysing the prospects of deal completion and will share our take on FIRB and counterparty dynamics in a follow-up.

For now, the key point is this:

We were long Santos when it was cheap. The model said so. The market caught up. We booked the win.

You can find the link to the files here:

Sources

1. Goldrock Capital NAV Model v6.2, 17 July 2025

2. Santos FY24 Annual Report & July 2025 Investor Presentation

3. AFR, “Everything you need to know about Santos’ deep-pocketed suitor”, 27 Jun 2025

4. Reuters, “ADNOC-led group bids $18.7b for Santos”, 15 Jun 2025

Disclaimer

This publication has been prepared by Goldrock Capital for informational and discussion purposes only. It does not constitute financial product advice, investment advice, legal advice, or a recommendation to buy or sell any security. The views expressed are solely those of the author(s) based on information believed to be reliable at the time of publication.

Goldrock Capital does not guarantee the accuracy or completeness of the data and disclaims any liability for decisions made based on this information. Past performance is not indicative of future results. Readers should conduct their own due diligence or consult a licensed financial adviser before making any investment decisions.