Screening for Value in ASX Resources and Energy

The resources sector is full of noise. There are hundreds of listed miners and energy companies on the ASX and most will never create long term value. Some are genuine operators with scale and cost advantages, others are little more than stories designed to raise capital. Our job is not to guess which commodity will spike next month. Our job is to narrow the field to a handful of companies where the odds are tilted in our favour.

The first step in our process is to run a screen. We are not looking for magic formulas or perfect foresight. We are looking for signals that help us separate businesses with substance from those priced on hope. Two of the most useful signals are:

How the market values the company relative to its book of assets (book to price).

How much upside equity analysts see from today’s share price (consensus target versus recent trading averages).

Book to price tells us what is already embedded in expectations. When net assets exceed market value it suggests either an opportunity or a warning. Sometimes it is a genuine discount. Sometimes it is the market being realistic about assets that may never earn a return.

Analyst upside is imperfect but still useful. It captures the collective judgment of people who model these companies for a living. At the same time it is important to acknowledge that smaller companies often have only one or two analysts covering them. This limited coverage can create bias or over representation of a single optimistic or pessimistic view. The result is that upside percentages can sometimes look extreme compared to the majors where coverage is broad and consensus is well balanced.

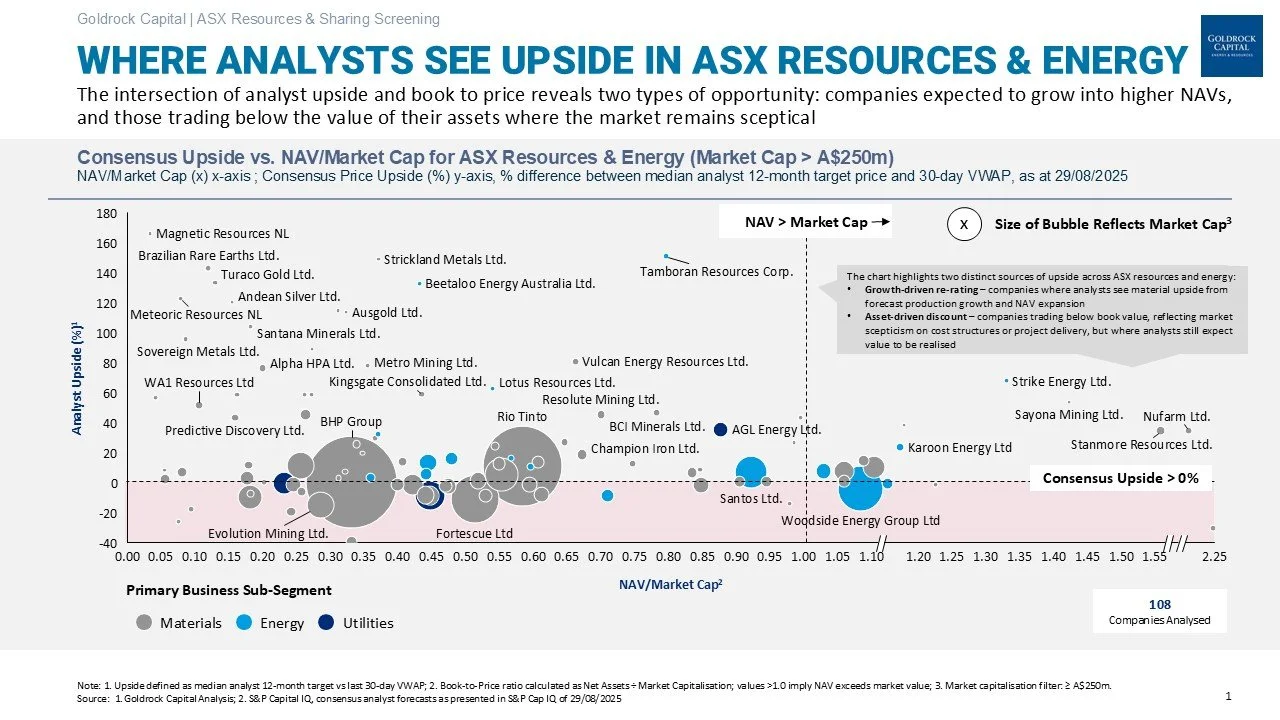

Chart 1: Where Analysts See upside in ASX Resources & Energy

When we plotted ASX resources and energy companies above $250m in market cap on these two dimensions (see Chart 1) a few things stood out.

The majors look fairly priced. BHP, Rio, Fortescue, Woodside, Santos. These names are well covered, heavily traded, and rarely mispriced for long. Upside is limited and book to price ratios sit around or below one. The market generally has them pegged. They anchor the sector but they are not where the surprises are.

The mid cap miners tell a different story. Companies like Emerald Resources, Resolute Mining, and WA1 Resources show substantial forecast upside despite trading on discounts to book. The market seems reluctant to credit them for future growth while analysts who follow the projects more closely are prepared to model in production expansions and NAV lifts. This gap is where mispricing can live.

Discounts are not uniform. Some companies trade below book because costs are too high or projects too marginal. Others have solid assets but sit in the wrong part of the cycle. Our screen does not solve that. It just flags where to look more carefully.

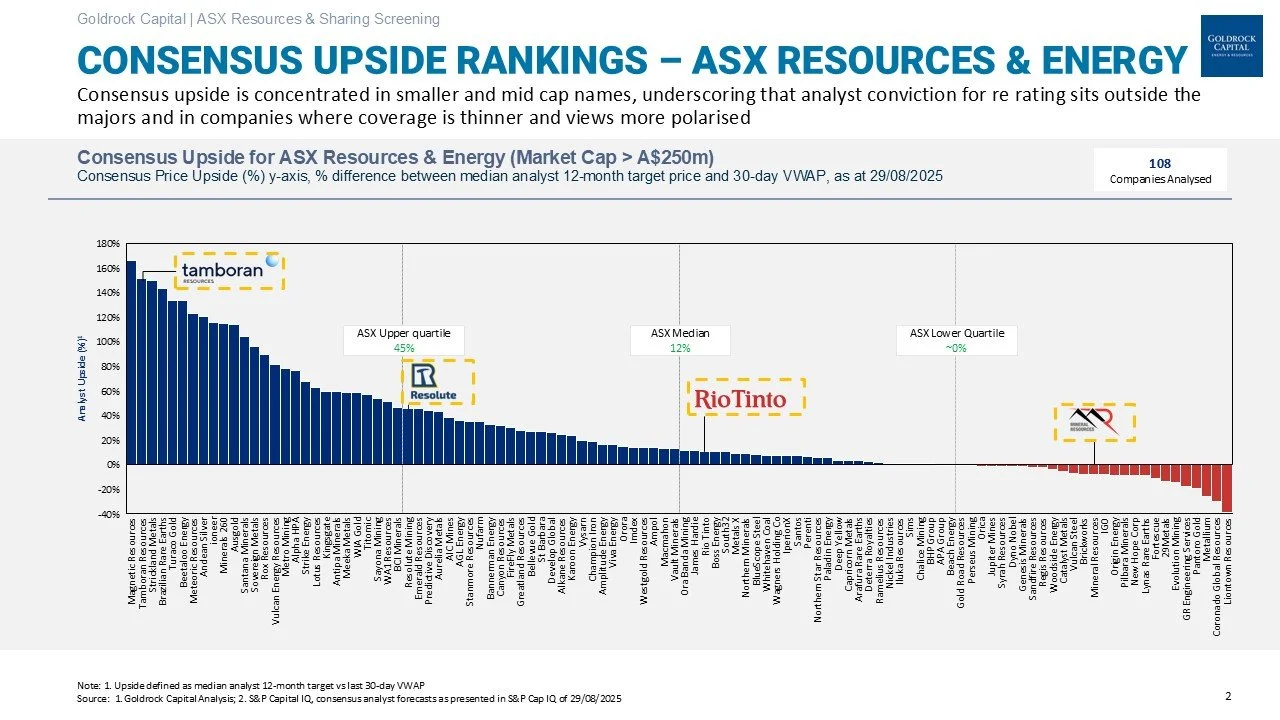

A ranked view of consensus upside (see Chart 2) makes the contrast sharper. The names with the largest expected re rating are not the household giants but the up and coming developers and second tier producers. Tamboran, Brazilian Rare Earths, Turaco Gold, Meteoric, Ausgold, Vulcan Energy. These are not risk free businesses. They are where analyst models see multiples of today’s price if projects are delivered.

Chart 2: Consensus Upside Rankings - ASX Resources & Energy

What do we take from this. First, cheapness has many faces. Some stocks are cheap because they are broken. Others are cheap because they are overlooked. Second, analyst upside is a useful filter but not an answer. It pushes us toward the parts of the market where perception and forecast diverge but it cannot tell us which view is right.

The purpose of screening is not to buy a stock because it looks cheap on paper. It is to build a shortlist of companies that deserve further work. From there we go deeper: cost curves, balance sheets, capital allocation, and management incentives. Without this first cut we would drown in the noise.

We share this openly because honesty matters. Investing is hard and there are no shortcuts. The best we can do is be disciplined in our process and transparent in our reasoning. Screening by book to price and analyst upside does not give us certainty. It gives us a better map of where the interesting pockets of the ASX resources sector may lie. And that is enough to start.

You can access the files here:

Disclaimer

This article is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. The data shown is based on consensus analyst estimates sourced from S&P Capital IQ and reflects information available at the time of writing. Analyst forecasts, particularly for smaller companies, may be limited in coverage and subject to bias. Goldrock Capital makes no representation as to the accuracy of third party estimates and accepts no liability for investment decisions made based on this material.