Mineral Resources Re-Rated: NAV Upgraded, But Is the Upside Now Capped

Mineral Resources (ASX:MIN) – Model Update & Valuation Refresh (Aug 2025)

Disclaimer: This is not financial advice. Please consult your own professional adviser before making any investment decisions.

Goldrock Equity Analyst Overview

Recommendation: HOLD (previously BUY)

Current Share Price: A$29.6

Updated Intrinsic NAV: A$36.10 (from A$29.50 as of Jun 1)

12-Month Target Price: A$34.00 (from A$25.00 as of Jun 1)

Implied Upside to Target: ~15%

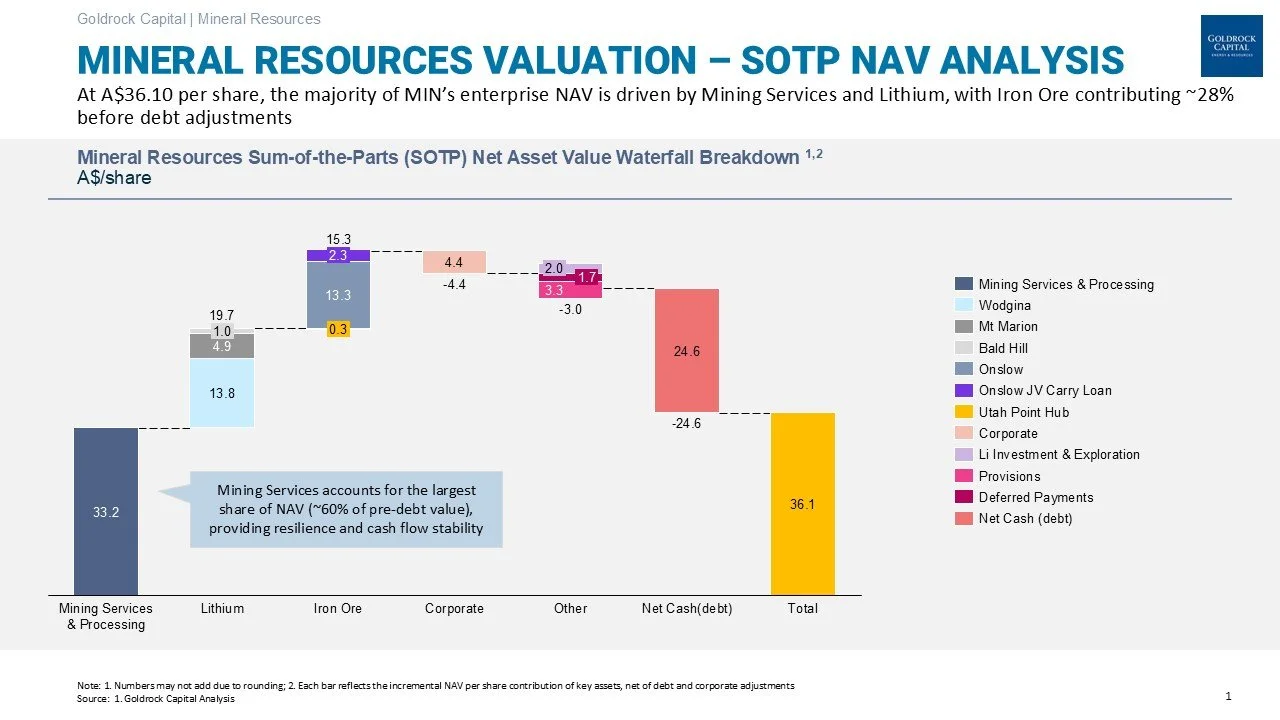

Mineral Resources Valuation - SOTP NAV Analysis

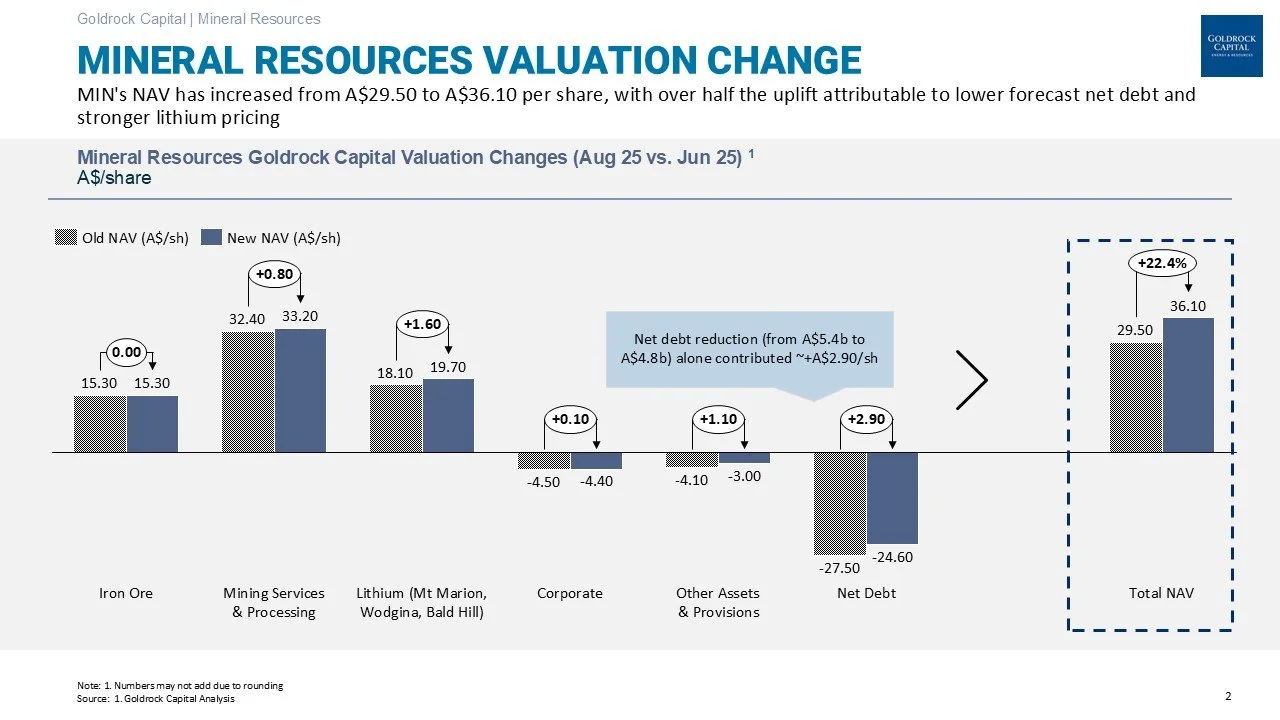

What’s Changed Since Our Last Post

We’ve refreshed our valuation model for MIN following updated FY25–26 forecasts. While underlying business assumptions are largely intact, the biggest driver of the uplift in NAV is a lower forecasted net debt position—falling from A$5.4b to A$4.8b by FY26, improving both equity value and balance sheet flexibility.

Key Upgrades in Assumptions

1. Net Debt – Key to Equity Value Re-Rating

Net debt falls from A$5.4b to A$4.8b, following higher free cash flow in FY25

This alone adds ~A$2.90/share to NAV, accounting for the majority of the uplift

Gearing ratio improves from 56% to 48%

ND/EBITDA falls from 5.3× to 2.8×

2. Iron Ore – Onslow Performance Lift

FY27 Onslow output (MIN share): Unchanged

Average realised iron ore price: Increased to US$96/t in FY26 (from US$90/t)

Unit costs remain unchanged: FY26 costs Trend lower to A$51–54/wmt

Net iron ore NAV unchanged A$15.3/sh

3. Lithium – Stronger Near-Term Recovery

Spodumene price : FY26 price updated to US$869/t (from US$838/t), and FY27 price updated to US$1120/t (from US$1115/t). FY28 to FY30 remains consistent with previous forecast of prices rebounding to US$1,394/t by FY30 (previously A$1,394/t)

MIN’s lithium volumes: ~575 kt SC6.0 by FY28 unchanged, but realised prices and margin expanded

Combined Mt Marion, Wodgina, and Bald Hill NAV lifted from A$18.1/sh to ~A$19.7/sh

3. Mining Services – Steadier Outlook

Volume guidance (FY26–28): Reaffirmed at 280–345 Mtpa

Services EBITDA contribution: Remains strong at ~47–49%

NAV Improvement: Increased by A$0.8/sh, underpinned by robust contract coverage

4. Balance Sheet & Cash Flow

Peak net debt: Unchanged at ~A$5.4b in FY25

Leverage trajectory: Faster deleveraging means ND/EBITDA improves to 1.0× by FY29

Free cash flow: Turns materially positive from FY26 onwards; dividend yield lifts to 4–6% range by FY28

Mineral Resources Valuation Change since last Forecast

Risks & Considerations

No major change to the downside scenarios – we continue to monitor:

Sustained lithium pricing below US$800/t

Delays or capex blowouts on Onslow or lithium JVs

Haul Road Viability

US Bond Yields (as they pertain to MinRes’ refinancing efforts)

Impact of Simandou (Guinea) project on longer term Iron Ore prices

Global mining capex downturn impacting Services volumes

Final Take

The rally in MIN’s share price has captured most of the short-term upside, reducing the valuation buffer. However, improving cash generation and debt reduction still support long-term value.

Rating: HOLD

Upside to our A$34.00 target (A$36.1 NAV) is now just 15%, but we remain constructive on the long-term fundamentals.

You can access the key slides here

Disclaimer: This is not financial advice.

If you’d like more detail on our underlying data and assumptions, please contact us at info@goldrock.com.au.

This analysis has been prepared by Goldrock Capital for informational purposes only and does not constitute financial advice, investment advice, or a recommendation to buy or sell any security. The figures presented are based on public information, industry benchmarks, and assumptions that may not reflect the actual internal costs or commercial decisions of Mineral Resources or its joint venture partners.

Readers should treat this analysis as indicative and not definitive. Goldrock Capital and its contributors accept no liability for any decisions made based on this content. Always conduct your own research or consult a licensed financial adviser before making investment decisions.